Having Trouble Renewing Your Road Tax? It Might Be Your Insurance Policy.

If you are the owner of a pre-owned car, you might have struggled with renewing your road tax online.

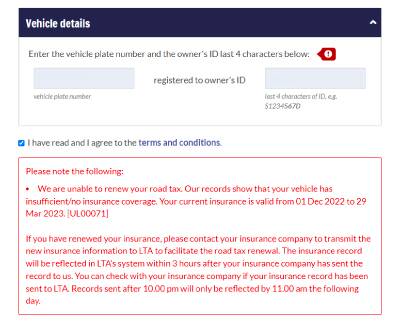

You may have obtained motor insurance at the time of your car purchase, but the Land Transport Authority (LTA) website (onemotoring.com) indicates that your insurance is not currently valid. Wondering what went wrong?

To renew and successfully pay for your road tax, you will have to:

- arrange for and pass a vehicle inspection, and

- prepare your certificate of insurance showing that you have valid insurance covering the entire duration of the new road tax period

For pre-owned cars, the most common issue is a misalignment between the road tax period and vehicle insurance policy coverage.

What does a misalignment mean?

First, some key points to consider:

- Road tax can only be purchased for periods of 6 months or 12 months.

- New insurance policies are available in 12-month periods.

- You can renew your road tax online only if your insurance period matches the road tax dates.

- Both road tax and vehicle insurance are necessary for you to legally drive your vehicle in Singapore.

This issue arises most commonly when you have purchase a pre-owned vehicle. The vehicle typically comes with some period of road tax remaining (from the previous owner). However, unlike road tax, insurance policies do not transfer along with the vehicle. You will have to purchase a new insurance policy for yourself. Consequently, the new insurance policy and the old road tax will likely not expire on the same day – this is what we mean by “misalignment”, or a policy “shortfall”.

This misalignment isn't problematic until the time comes to renew your road tax. Let's illustrate this with an example.

Realignment of insurance and road tax

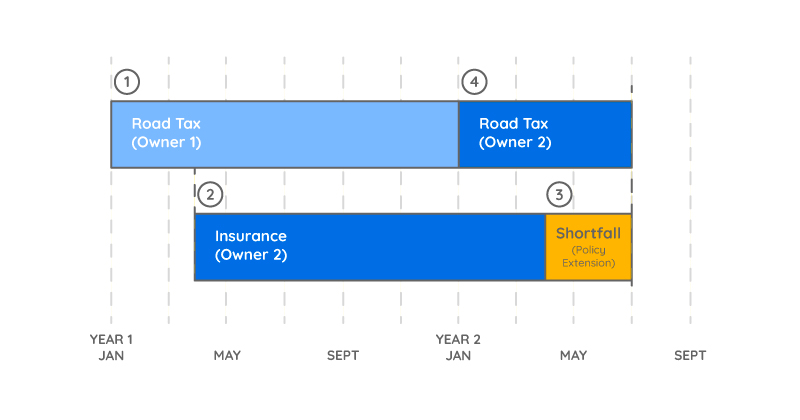

The graphic above shows an example where road tax and insurance might misalign:

- Owner 2 buys a car from Owner 1 in April and purchases a new 1-year insurance policy for the vehicle starting from the day he bought the car in April. However, the road tax for the vehicle, which Owner 1 originally purchased, still has eight months remaining before it expires the following January.

- Later, when Owner 2 attempts to renew the road tax, he is informed that his insurance coverage is insufficient for the new road tax period. The new road tax period will extend beyond the current insurance coverage, and end in June, resulting in a two-month gap between insurance and road tax periods.

- To resolve this, Owner 2 must extend his insurance policy by two months (till June) to cover the shortfall.

- The LTA system will automatically update and recognise this insurance policy extension. Afterwards, Owner 2 can then purchase six months of road tax, which will realign his policy and road tax periods.

So how do I ensure that my road tax and insurance periods align?

When you purchase a pre-owned vehicle, ask about the option of purchasing the insurance for the car for more than 1 year, to match with the road tax period. An experienced insurance intermediary would be able to arrange this for you.

For eazy customers, we can help to extend your vehicle insurance policy to create sufficient runway to match your road tax. We will extend your policy for the necessary duration (with a pro-rated cost), so that you can have a seamless road tax renewal journey. Extend your insurance period with the form here.