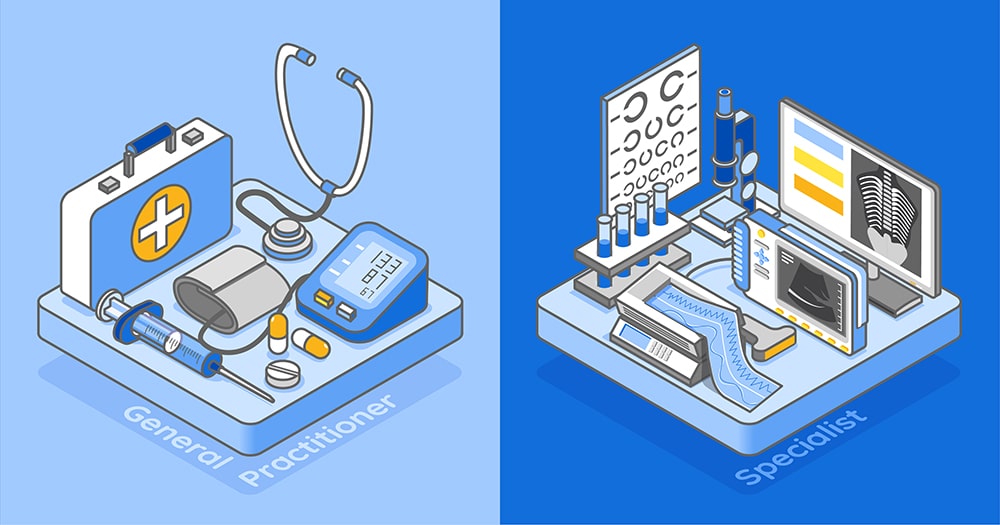

Understanding Outpatient Coverage: GP vs Specialist

In today's fast-paced world, employee well-being has become a top priority for companies. One of the main ways to ensure employees remain healthy and productive is by offering comprehensive healthcare benefits for employees, including outpatient employee benefits. This insurance coverage typically includes visits to general practitioners (GP) and specialists (SP), ensuring that employees have access to necessary medical care when they need it most.

Key Components of Company Outpatient Group Insurance

Outpatient care refers to medical services that do not require overnight hospitalization. This can include consultations with general practitioners, specialist consultations, diagnostic tests, and minor treatments that can be done in an outpatient setting.

General Practitioner (GP) Coverage: General practitioners are often the first point of contact for employees when they are feeling unwell. Outpatient GP coverage ensures that employees can seek medical attention without worrying about the financial burden. Depending on the policy, coverage may include:

- Consultation fees

- Prescribed medication

- TCM

- Teleconsultation & Medication

- Refer patients to a specialist for complex health issues

GPs play a crucial role in primary care. By offering GP medical coverage, employers ensure that their workforce has easy access to essential healthcare services.

Specialist Coverage: For more complicated cases, employees may need to consult a doctor with more expertise in treating their specific condition, and this is where specialist coverage comes in. Specialists are often consulted for more complex medical conditions or when a referral from a GP is necessary. Specialist consultations may include services such as:

- Medical advice and treatment for specific conditions (e.g., cardiology, dermatology, orthopaedics, etc.)

- Chronic medical conditions

- Advanced diagnostic procedures (e.g., MRIs, X-rays, lab tests)

- Follow-up care after surgery or a medical condition

Specialist consultations typically require a referral from a GP, although some plans may waive the need for a referral letter to simplify the process.

Considerations when purchasing outpatient coverage

Here are some of the main things to look out for when purchasing outpatient coverage:

- Policy Limits and Exclusions: Employers should be aware of the limitations and exclusions of their outpatient coverage. Health screening, vaccinations, supplements and vitamins are common exclusions in most outpatient coverages. For SP coverage, it could be a good idea to opt for a plan with a higher annual limit as specialists tend to charge a much higher price compared to GPs.

- Co-payment: Some outpatient insurance plans require employees to pay a portion of the costs, known as co-payment. Employers should carefully review the policy terms and consider employee affordability when selecting a plan.

- Panel & Non-Panel: It is important to check whether the plan offers coverage for non-panel clinics. If your plan only covers panel clinics, employees must ensure that they visit only a panel GP or SP to ensure that their claim is admissible. Even for plans which cover non-panel clinics, the claimable amount is usually much lower, so be sure check your policy limits before visiting the clinic.

How to make a claim for outpatient coverage

For panel clinics, most insurers offer a cashless payment. Employees will have to display their e-medical card upon registration at the clinic, and the insurer will handle the payment. For non-panel clinics, employees would usually have to make payment first, and the insurer will reimburse them later.

One important thing to take note is that for a visit to a Specialist, a referral letter from a panel GP is usually required, unless stated otherwise in the policy. A specialist claim may be rejected if the visit to the specialist was not referred by a GP.

Conclusion

Outpatient GP and SP coverage provides employees with valuable access to essential healthcare services with group insurance. Offering this benefit not only promotes better employee health but also enhances productivity, employee satisfaction, and overall well-being. As healthcare costs continue to rise, companies that invest in a comprehensive outpatient package ensure that their employees have the support they need to remain healthy and focused at work. If you are looking to explore more on outpatient coverage, eazy is an experienced broker that can help you find the right coverage that suits your needs. Please feel free to contact us and our team will be happy to assist you.

Contact us for policy quotation,

comparison and unbiased advice now!